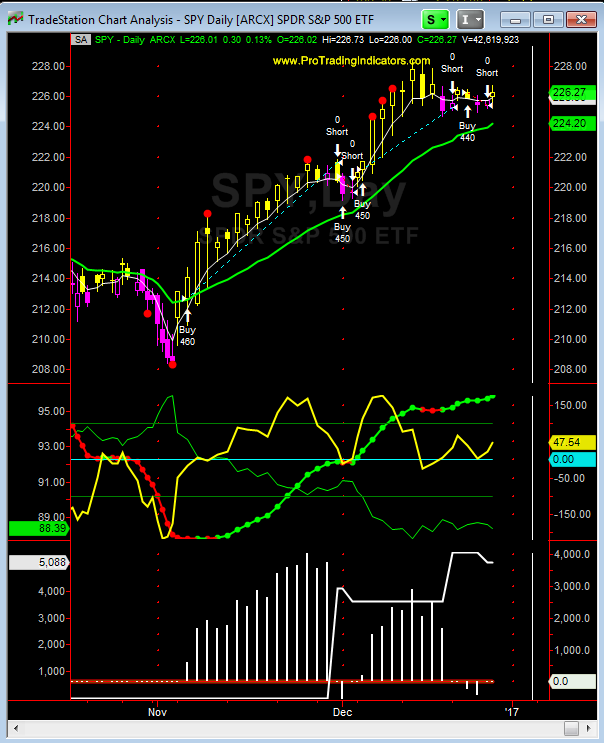

TREND TRADE: Long from open, 1/4.

SWING TRADE: Long from open, 1/4.

DAY/SCALP TRADE: Buying the dips…

PRICE TREND: Nasdaq up 6 days.

SETUP:

The rally, which began on the open of 1/4, is now five days old. It can go higher. In fact breadth is indicating it will, at least for one more day.

But…

Five days in a row put the Nasdaq on borrowed time. Trader Vic Sperandeo used to say “if the market doesn’t do what it is expected to do, it will do the opposite twice as much.” I still expect it to go up more, but I’m also on the alert to the “twice as much.”

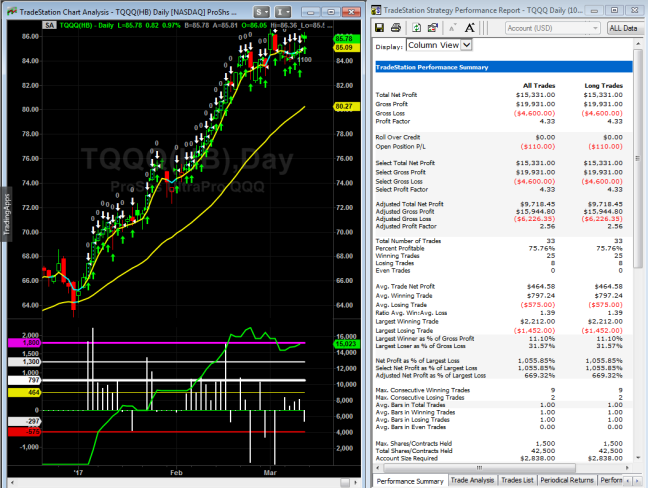

On this rally, it has mostly been Nasdaq, Nasdaq and more Nasdaq so far. TQQQ, the 3x-leveraged ETF I use for that index is up 7.2% in these five days, XIV is up 6.7% while UPRO, keyed to the S&P, is flat as is TNA, keyed to the Russell.

Among the leveraged sector ETFs, LABU (biotechs) is up 32%…32% in five days!

Notable Nasdaq stocks participating in the rally include AAPL up 2.8%, AMGN 4.4%, AMZN 4.8%, TSLA 6.9%, FB up 5.7%; the number-one stock in my nifty-fifty stock list, HIIQ is up 16.2% on this five-day run (one of these days I’m going to have to look that symbol up and see what that company is and what it does).

Anyway this is what market timing is all about. I’m recording it her for my own amusement, and mine alone, but whenever anyone says it’s impossible to time the market I tell them to go back to school.

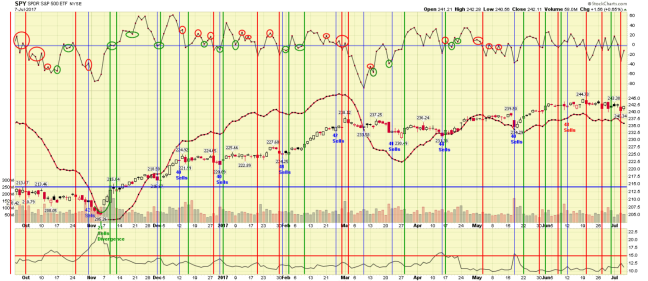

On the chart below that last green circle in the upper right indicates this rally may have more to go but again…”the twice as much” if not…

(right click on the chart for a larger view)