Looks like it is time for the bounce from Friday to continue.

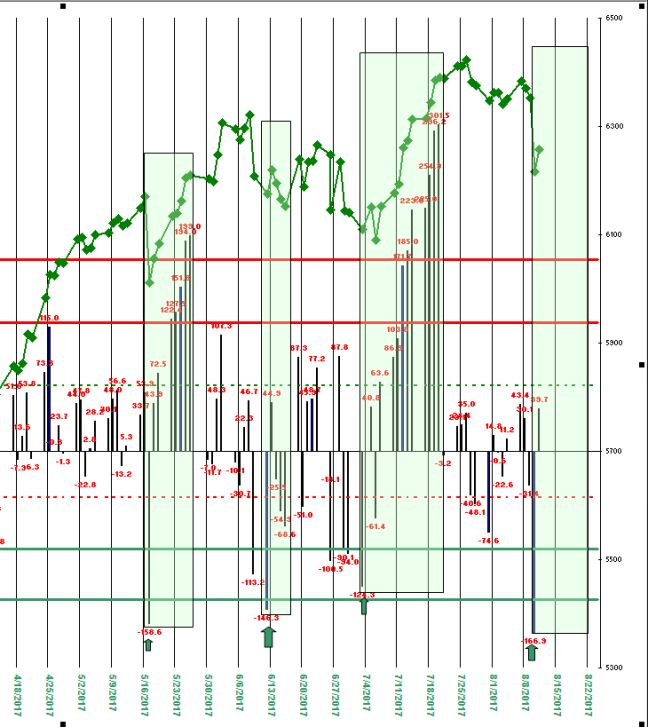

All three of my swing-trading signals – Price, Breadth, Volatility – gave buys for Monday’s open after last Thursday’s hard slam to the downside and Friday’s bounce.

Everything is still oversold.

My Nifty-50 stock list had 39 nine stocks on sells Friday for the second day in a row. Forty sells is a marker for a bottom of a swing but sometimes the market just goes to far to fast and doesn’t quite get down that far. Also 30 of those stocks are oversold. Thirty is a lot.

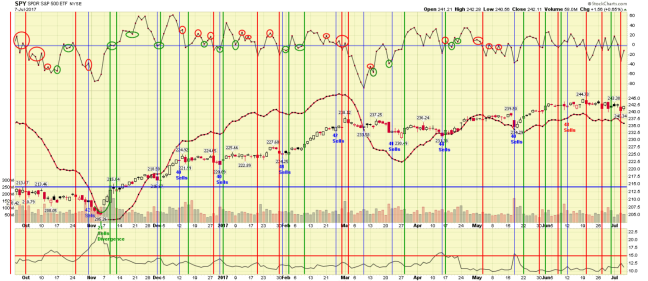

The plunge in price Thursday took the Nasdaq Comp to a level that often marks a bottom, and made Friday’s bounce almost a sure thing (see the chart below of the Nasdaq Comp with the previous signals). Given this bull market it is more likely than not we move up again now.

Caution is needed, however, since long-term breadth remains negative and there is no divergence in short-term breadth so it should be noted that a test or retest of Friday’s lows some time this coming week is also likely.

SWING TRADING SIGNALS:

PRICE: Buy. Price (Day 1).

SHORT-TERM BREADTH: Sell. (Day 1).

VOLATILITY: Buy, (Day 1).

CONTEXT:

LONG-TERM BREADTH: Sell (Day 8).

CNN MONEY’S FEAR AND GREED INDEX: (28, greed level).

NIFTY-50 STOCK LIST: 11 Buys; 1 Overbought, 30 Oversold, 4 new buys today, 4 new sells.

Stocks in the Nifty-50 list on buy signals: EXAS, CC, CZR and MELI.

(click on the chart for a larger view)