My Nifty-50 stock list went from 39 stocks on sells with 30 oversold at the beginning of the day to 43 on buys and 11 overbought at the close. There were 34 new buy signals on the stocks today.

Thirty-four buys in one day. Can’t remember when last a one-day blast like today happened in the stocks.

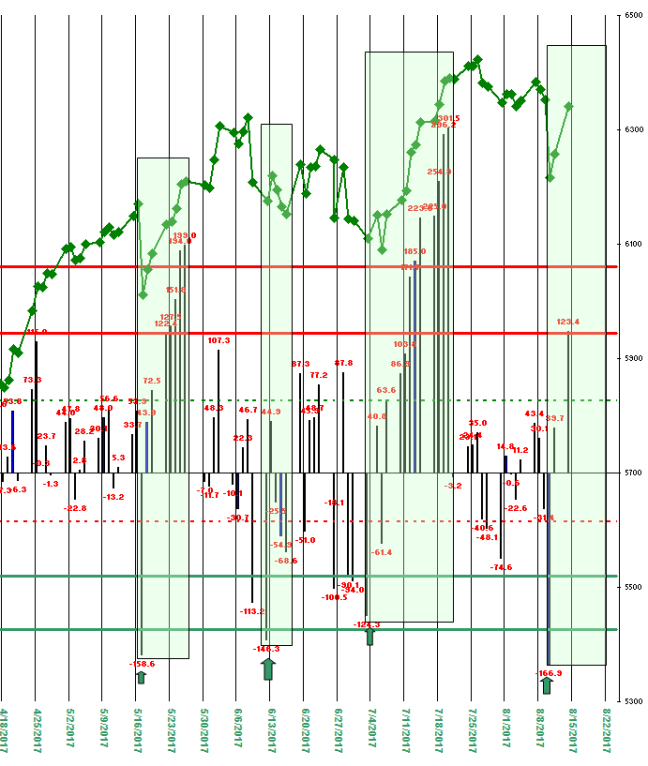

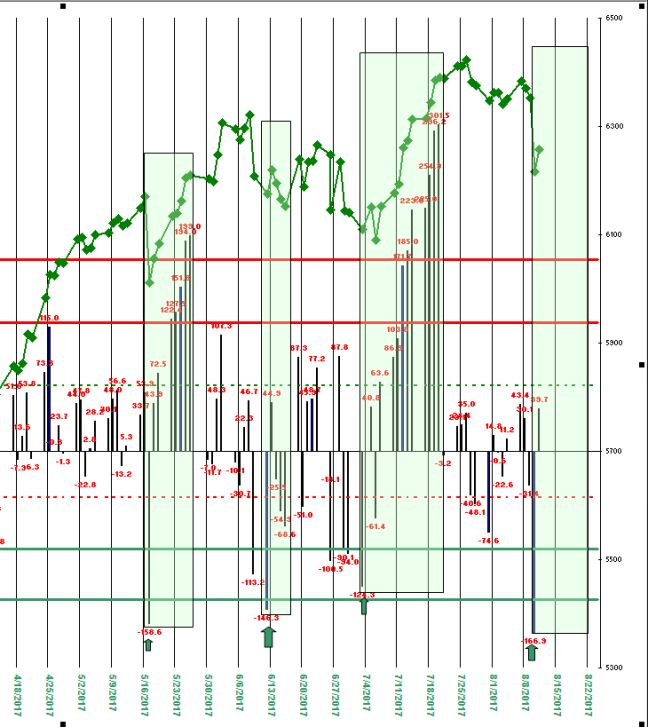

I think the telling number going into today’s trading was that 30 oversold in addition to upthrust from the lower green line and arrow on the chart posted yesterday and updated today (below).

This feels like a buying panic that could I suppose carry to new highs especially on the Nasdaq.

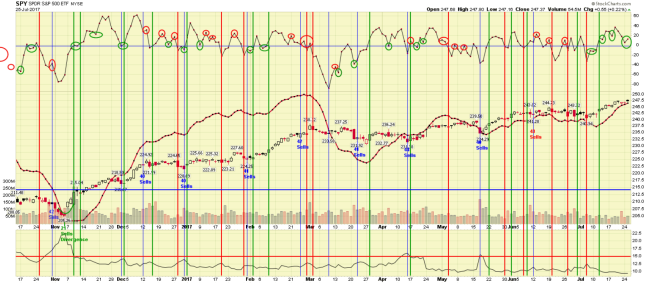

On the S&P it seems more likely it goes up to the levels it was at when it sold off last week and stall (that would be about 247-248 on the SPY, which closed at 246.54 today). If so then we will likely see a retest of last week’s low levels, particularly because long-term breadth is still negative and there is no divergence in the short-term breadth numbers.

But for now this is an obvious bull market that is still going up until one day it is obviously going down.

SWING TRADING SIGNALS:

PRICE: Buy. Price (Day 2).

SHORT-TERM BREADTH: Sell. (Day 2).

VOLATILITY: Buy, (Day 2).

CONTEXT:

LONG-TERM BREADTH: Sell (Day 9).

CNN MONEY’S FEAR AND GREED INDEX: (39, but still at a greed level).

NIFTY-50 STOCK LIST: 43 Buys; 11 Overbought, 1 Oversold, 34 new buys today, 0 new sells.

Stocks in the Nifty-50 list on buy signals: too numerous to list but highlights from on the day include KEM up 7.5%, NVMI up 6.2%, PNK up 6.0% and MOMO up 5.5%.

(click on the chart for a larger view)