This site is migrating to http://www.thegodoftrading.com/.

#MarketTiming – beware the ides of August…

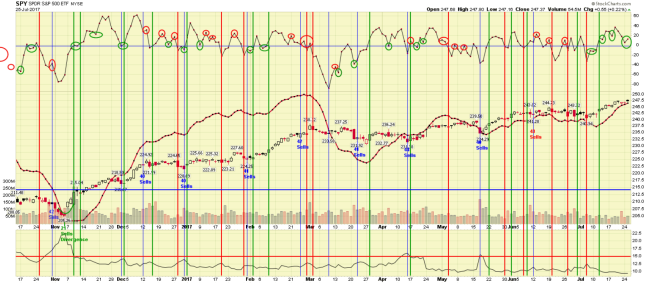

SPY gaped up today, hit yesterday’s suggested 247 resistance on the first five-minute bar, and turned down, down not so much but maybe enough given that that is a lower high since last week’s nuclear Tuesday reversal.

In addition my daily price and breadth indicators also gave sell signals with lower highs. Volatility remains on a buy but it is for the third day in a row which makes any more time tenuous. If it were to turn it would give a higher low in the VIX, a possible hint a change in trend.

Today’s turn down in short-term breadth (see red circle on the chart below) in context with the continued decline in long-term breadth is often a gift the the bears, which is to say the general market should plunge tomorrow.

These are all quiet signals after yesterday blast to the upside which may mean they mean nothing at all and today’s long sideways price action after the open was nothing but a consolidation of yesterday’s gain before proceeding higher.

But these quiet, disquieting, signals could also be like whispers in the night — “beware the ides of August, beware…”

How often has the market topped quietly in August and fallen all the say into October?

SWING TRADING SIGNALS:

PRICE: Sell. Price (Day 1).

SHORT-TERM BREADTH: Sell. (Day 1).

VOLATILITY: Buy, (Day 3).

CONTEXT:

LONG-TERM BREADTH: Sell (Day 10).

CNN MONEY’S FEAR AND GREED INDEX: (36, still at a fear level).

NIFTY-50 STOCK LIST: 42 Buys; 13 Overbought, 2 Oversold, 2 new buys today, 3 new sells.

(click on the chart for a larger view)

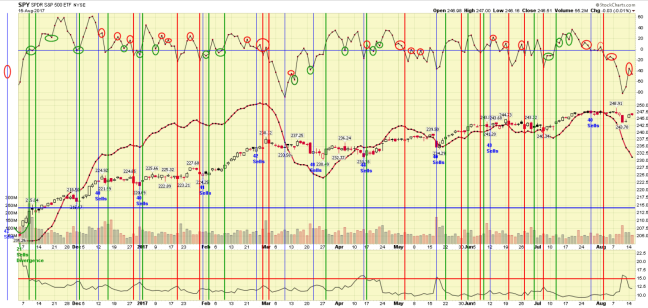

#MarketTiming — well…that was a big bounce…

My Nifty-50 stock list went from 39 stocks on sells with 30 oversold at the beginning of the day to 43 on buys and 11 overbought at the close. There were 34 new buy signals on the stocks today.

Thirty-four buys in one day. Can’t remember when last a one-day blast like today happened in the stocks.

I think the telling number going into today’s trading was that 30 oversold in addition to upthrust from the lower green line and arrow on the chart posted yesterday and updated today (below).

This feels like a buying panic that could I suppose carry to new highs especially on the Nasdaq.

On the S&P it seems more likely it goes up to the levels it was at when it sold off last week and stall (that would be about 247-248 on the SPY, which closed at 246.54 today). If so then we will likely see a retest of last week’s low levels, particularly because long-term breadth is still negative and there is no divergence in the short-term breadth numbers.

But for now this is an obvious bull market that is still going up until one day it is obviously going down.

SWING TRADING SIGNALS:

PRICE: Buy. Price (Day 2).

SHORT-TERM BREADTH: Sell. (Day 2).

VOLATILITY: Buy, (Day 2).

CONTEXT:

LONG-TERM BREADTH: Sell (Day 9).

CNN MONEY’S FEAR AND GREED INDEX: (39, but still at a greed level).

NIFTY-50 STOCK LIST: 43 Buys; 11 Overbought, 1 Oversold, 34 new buys today, 0 new sells.

Stocks in the Nifty-50 list on buy signals: too numerous to list but highlights from on the day include KEM up 7.5%, NVMI up 6.2%, PNK up 6.0% and MOMO up 5.5%.

(click on the chart for a larger view)

$USD – a vote on the country ever day…(Updated chart)

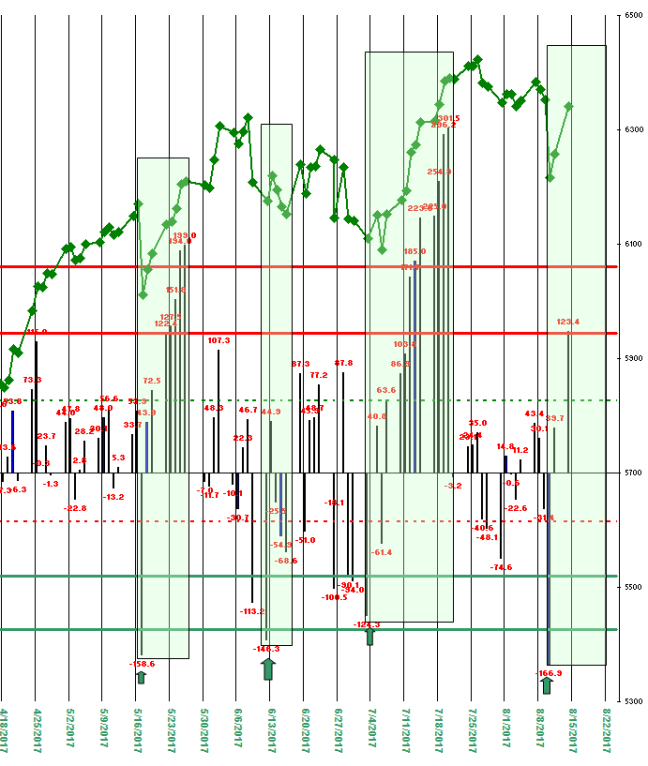

$SPY $QQQ – bouncy bounce time…

Looks like it is time for the bounce from Friday to continue.

All three of my swing-trading signals – Price, Breadth, Volatility – gave buys for Monday’s open after last Thursday’s hard slam to the downside and Friday’s bounce.

Everything is still oversold.

My Nifty-50 stock list had 39 nine stocks on sells Friday for the second day in a row. Forty sells is a marker for a bottom of a swing but sometimes the market just goes to far to fast and doesn’t quite get down that far. Also 30 of those stocks are oversold. Thirty is a lot.

The plunge in price Thursday took the Nasdaq Comp to a level that often marks a bottom, and made Friday’s bounce almost a sure thing (see the chart below of the Nasdaq Comp with the previous signals). Given this bull market it is more likely than not we move up again now.

Caution is needed, however, since long-term breadth remains negative and there is no divergence in short-term breadth so it should be noted that a test or retest of Friday’s lows some time this coming week is also likely.

SWING TRADING SIGNALS:

PRICE: Buy. Price (Day 1).

SHORT-TERM BREADTH: Sell. (Day 1).

VOLATILITY: Buy, (Day 1).

CONTEXT:

LONG-TERM BREADTH: Sell (Day 8).

CNN MONEY’S FEAR AND GREED INDEX: (28, greed level).

NIFTY-50 STOCK LIST: 11 Buys; 1 Overbought, 30 Oversold, 4 new buys today, 4 new sells.

Stocks in the Nifty-50 list on buy signals: EXAS, CC, CZR and MELI.

(click on the chart for a larger view)

$UVXY – big swing but watch out this week…

Got the UVXY swing for 50-plus percent off the 11 consecutive days down.

See the July 23rd post below: “UVXY – what a week this could be…”

Note the red dots on the UVXY chart below and the reversal on the VIX Friday.

Likely some upside to continue from Friday’s bounce into this week before any retest of this last week’s decline.

(click on chart for a larger view)

$XIV – up 63% on swing trades YTD…

Haven’t posted here for a while. Out of sheer laziness.

In that time, the market gave a buy for today’s open on all three of my swing trading signals – Price, Breadth, Volatility. As a day trade the primary leveraged ETFs I follow were up modestly — TQQQ up 1.28 percent from the open, XIV up .83 percent, UPRO up .34 percent.

Breadth gave a sell for tomorrow’s open so will take some off the table but the other two signals remain in place.

Over at Traders-Talk.com the question was asked today: “Is anyone doing anything novel with the VIX?” I’m not going to tell exactly what is the novel I’m doing except to say I use the VIX to generate the Volatility swing signal, and I suppose this is as good a time as any, to note that XIV, the 3x-leveraged ETF based on the VIX, going long only is up 63 percent on thirty-eight swing signals year to date (with 65% of the trades profitable).

The Volatility signal is posted here everyday (or sometimes, like today, when I get around to it):

SWING TRADING SIGNALS:

PRICE: Buy. Price (Day 2).

SHORT-TERM BREADTH: Sell. (Day 1).

VOLATILITY: Buy, (Day 2).

CONTEXT:

LONG-TERM BREADTH: Sell (Day 4).

CNN MONEY’S FEAR AND GREED INDEX: (63, greed level).

NIFTY-50 STOCK LIST: 33 Buys; 13 Overbought, 6 Oversold, 9 new buys today, 1 new sells.

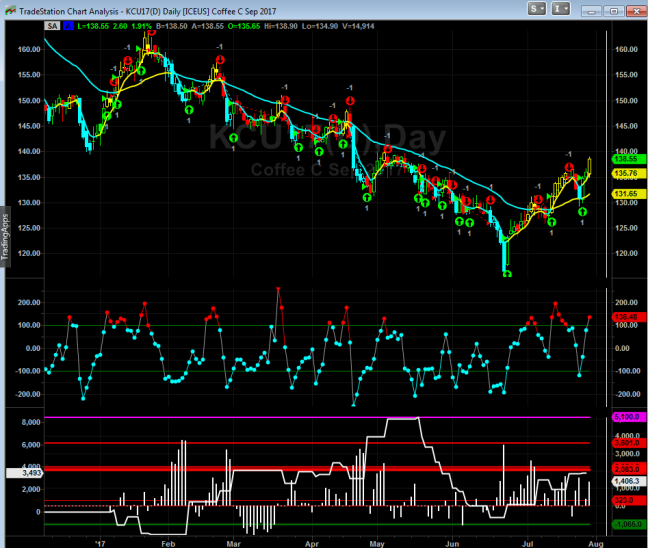

$KC – a textbook trend change in coffee…

Simply put, after a long choppy but steady down trend, coffee has changed course to an up trend, breaking it’s down sloping moving average, then retesting it perfectly before resuming its new trend to the upside.

Nothing more to say. The chart says it all.

(click on chart for a larger view)

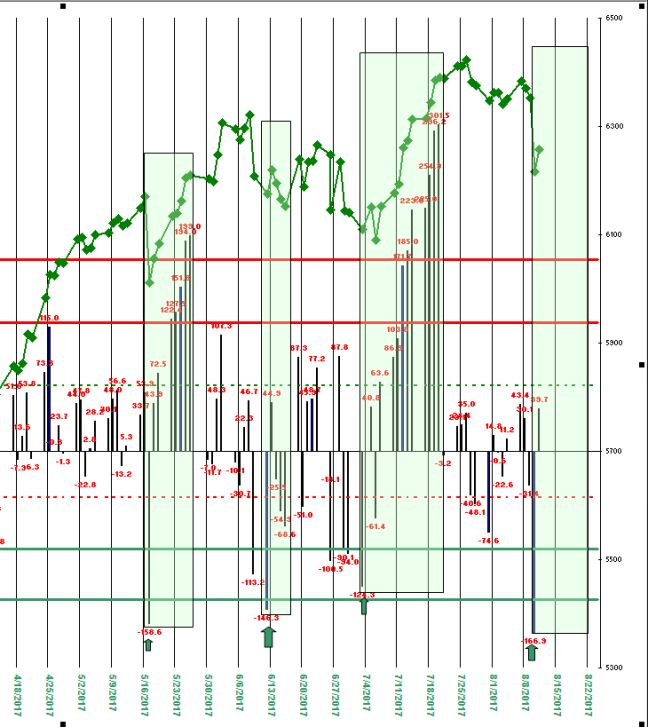

$QQQ – one-day dip or shot across the bow?

Mid-day today, the Nasdaq sold off – out of the blue and just when everyone was talking about Jeff Bezos of Amazon being the new richest man in the world supplanting Microsoft’s Bill Gates.

Amazon (AMZN) was up 30-some points at the time and finished down for the day, and is now down 55 points for the day in the aftermarket. It’s possible Bezos was the richest man for an hour or so but maybe he still is (someone else, like Forbes, will have to keep track of that).

The reversal ripped through the rest of the Nasdaq 100 (NDX) and the Nasdaq composite. And tore my nifty-50 stock list into 40 stocks on sells. That many sells or more, if not a bottom of a swing, is usually the beginning of a bottom.

In addition, the Dow and the SPX remained up so it is hard to tell the answer to the question in the title above.

Of course, tomorrow will tell.

All three of my end-of-the-day swing trade signals – price, breadth, volatility – are on sells and long-term breadth turned negative but just by a bit.

If the Nasdaq follows through to the downside and takes<the rest of the market with it, the price sell-off threatened over and over again in the internals (breadth and volatility) may finally be at hand.

SWING TRADING SIGNALS:

PRICE: Sell. Price (Day 1).

SHORT-TERM BREADTH: Sell. (Day 2).

VOLATILITY: Sell, (Day 4).

CONTEXT:

LONG-TERM BREADTH: Sell (Day 1).

CNN MONEY’S FEAR AND GREED INDEX: (73, greed level).

NIFTY-50 STOCK LIST: 10 Buys; 8 Overbought, 14 Oversold, 21 new buys today, 4 new sells.

(click on the chart for a larger view)

#MarketTiming – chopping at highs…

Kind of a weird choppy day.

Dow up a lot, SPY and Russell touch new highs, Nasdaq not hardly up at all.

And yet two of my three end-of-the-day signals – price and short-term breadth – are on buys signals, the third – volatility – missed registering a buy today by a whisper so I guess we’ll see what tomorrow brings.

Long-term breadth remains positive so there is a good chance the market does move higher tomorrow.

This is a ragged and scary market now which is what bull markets do to traders while investors just blithely hold on until all hell breaks loose (as it always does eventually). The VIX particularly at the moment is making a low not since 2007 just before the last time hell came to visit.

SWING TRADING SIGNALS:

PRICE: Positive. Long (Trade Day 2).

SHORT-TERM BREADTH: Negative. Flat (Day 1).

VOLATILITY: a sell on tomorrow’s open, Flat (Day 2).

CONTEXT:

LONG-TERM BREADTH: Positive (Day 10).

CNN MONEY’S FEAR AND GREED INDEX: (81, rocketed to the extreme greed level).

NIFTY-50 STOCK LIST: 30 Buys, flying; 22 Overbought, 3 Oversold, 8 new buys today, 3 new sells.

(click on chart for a larger view)